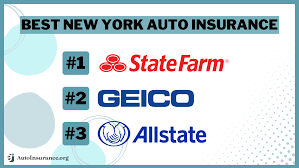

Top Auto Insurance Companies in New York State

Sure, here’s a paragraph about the top auto insurance companies in New York State:New York State has several top auto insurance companies that provide comprehensive coverage and excellent customer service. These companies offer a range of policies tailored to meet the diverse needs of New York drivers.

With competitive rates and reliable claims processing, the top auto insurance companies in the state ensure that policyholders have peace of mind on the road. Whether it’s for basic liability coverage or full-coverage insurance, New York residents have access to reputable insurance providers that prioritize customer satisfaction and financial protection.

Choosing the Right Auto Insurance Provider in New York

Choosing the right auto insurance provider in New York can be a crucial decision for every car owner. With so many options available, it’s important to do thorough research and consider various factors before making a choice. One of the key considerations is the provider’s reputation and financial stability.

You want to ensure that the company has a strong track record of providing reliable coverage and timely claims processing. Additionally, it’s essential to assess the coverage options and policy terms offered by different providers. Look for comprehensive coverage that suits your needs and preferences, including liability coverage, collision coverage, and comprehensive coverage.

Another important aspect to consider is the provider’s customer service. You want to choose a company that offers excellent customer support and is responsive to your queries and concerns. Finally, don’t forget to compare the premium rates offered by different providers. While cost should not be the sole deciding factor, it’s important to find a balance between premium affordability and the level of coverage provided.

By carefully evaluating these factors, you can make an informed decision and choose the right auto insurance provider in New York.

Factors to Consider When Selecting an Auto Insurance Company in New York

When selecting an auto insurance company in New York, there are several factors to consider. First and foremost, it is important to research the company’s reputation and financial stability. A reputable company with a strong financial standing will give you peace of mind that they will be able to fulfill their obligations in the event of an accident.

Additionally, it is crucial to evaluate the coverage options they offer and ensure they align with your needs. Consider factors such as liability coverage, comprehensive coverage, and deductibles. Furthermore, it is advisable to compare quotes from multiple insurance providers to find the best rates.

Remember, price should not be the sole determining factor, as quality of service and customer satisfaction are equally important. Lastly, check if the company offers any discounts or benefits that may be applicable to you. By carefully considering these factors, you can make an informed decision when selecting an auto insurance company in New York.

Comparing Auto Insurance Rates in New York State

Comparing Auto Insurance Rates in New York State can be a daunting task. With so many insurance providers to choose from, finding the best rates can feel like searching for a needle in a haystack. However, with a little research and some smart decision-making, you can save yourself a significant amount of money.

New York State has specific requirements for auto insurance coverage, so it’s important to understand what you need. Liability insurance is mKamutory and covers injuries or damages you may cause to others. Additionally, personal injury protection (PIP) is also required, which covers medical expenses for you and your passengers.

When comparing rates, be sure to consider factors such as your age, driving record, and the type of vehicle you own. Insurance providers will take these factors into account when determining your premium. Shopping around and obtaining quotes from multiple providers will give you a better idea of the rates available to you.

It’s also worth considering bundling your auto insurance with other policies, such as home or renter’s insurance. Many providers offer discounts for multiple policies, which can result in significant savings.Another important aspect to consider is the deductible. This is the amount you will have to pay out of pocket before your insurance kicks in.

Opting for a higher deductible can lower your premium, but be sure to choose a deductible that you can comfortably afford in the event of an accident.Finally, don’t forget to read reviews and consider the reputation of the insurance provider. A low rate may not be worth it if the company has a poor claims process or customer service.

In conclusion, comparing auto insurance rates in New York State requires some time and effort, but the potential savings are well worth it. By understanding your coverage needs, shopping around, and considering various factors, you can find the best rates and ensure you have the coverage you need in case of an accident.

So, take the time to do your research and make an informed decision. Your wallet will thank you!

Understanding Auto Insurance Coverage Requirements in New York

Understanding auto insurance coverage requirements in New York is essential for all drivers in the state. New York law mKamutes that all drivers maintain a minimum level of auto insurance coverage to legally operate a vehicle. This coverage includes liability insurance to cover property damage and bodily injury liability.

Additionally, drivers must carry uninsured motorist coverage and personal injury protection (PIP). Understanding these requirements is crucial to ensure compliance with the law and to protect oneself in the event of an accident. Failure to maintain the necessary coverage can result in severe penalties, including fines and potential license suspension.

Therefore, it is imperative for all New York drivers to familiarize themselves with the state’s auto insurance coverage requirements to drive with confidence and peace of mind.

Tips for Finding Affordable Auto Insurance in New York

Finding affordable auto insurance in New York can be a challenging task. However, with the right tips and strategies, you can save money while ensuring that you have adequate coverage. First and foremost, compare multiple insurance providers to get an idea of the different rates and coverage options available.

Consider factors such as deductibles, limits, and discounts offered. It’s also important to maintain a good driving record as this can help lower your insurance premiums. Additionally, bundle your auto insurance with other policies such as home or renters insurance to potentially receive discounts.

Another tip is to increase your deductibles, which can help reduce your monthly premiums. Lastly, ask about available discounts such as for safe driving, anti-theft devices, or defensive driving courses. By following these tips, you can find affordable auto insurance in New York without compromising on coverage.

Exploring the Benefits of Local Auto Insurance Companies in New York

Local auto insurance companies in New York offer a range of benefits that cater specifically to the needs of local drivers. By choosing a local provider, policyholders can enjoy personalized customer service, tailored coverage options, and a deeper understanding of the unique driving conditions in the state.

Additionally, local insurers often have a strong understanding of the local regulations and can provide timely assistance in the event of a claim. Supporting local insurers also contributes to the community’s economic growth and stability. Furthermore, local companies prioritize building long-term relationships with their clients, fostering trust and reliability.

Ultimately, opting for a local auto insurance company in New York not only ensures comprehensive coverage but also fosters a sense of community and support.

Common Mistakes to Avoid When Buying Auto Insurance in New York

When buying auto insurance in New York, it’s crucial to steer clear of common mistakes that could impact your coverage. One common error is underestimating the coverage needed for personal injury protection, especially in a no-fault state like New York. Additionally, failing to disclose all drivers who may operate the insured vehicle could lead to complications in the event of a claim.

Another mistake to avoid is settling for the minimum liability coverage required by law, as this may not provide sufficient protection in the event of a serious accident. Lastly, overlooking the option of uninsured/underinsured motorist coverage leaves you vulnerable to potential financial strain if involved in an accident with an uninsured driver.

It’s essential to carefully consider these factors to ensure your auto insurance adequately safeguards you on New York’s roads.

How to File an Auto Insurance Claim in New York

Filing an auto insurance claim in New York can be a straightforward process if you follow the necessary steps. First, ensure everyone involved is safe and call the police if needed. Then, exchange information with the other party, including insurance details. It’s crucial to notify your insurance company promptly and provide all relevant information, such as the location and time of the incident.

Document the damages with photographs and gather any witness contact information. Be prepared to answer any questions from your insurance adjuster and follow their guidance closely. By staying organized and proactive, you can navigate the auto insurance claim process in New York efficiently.

The Role of Auto Insurance Agents in New York State

Auto insurance agents in New York State play a crucial role in assisting individuals and businesses in navigating the complex landscape of insurance policies and regulations. These agents act as intermediaries between insurance companies and clients, helping them understand their coverage options, choose the most suitable policies, and file claims when necessary.

By providing personalized guidance and expertise, auto insurance agents ensure that their clients are adequately protected and informed about the intricacies of auto insurance in the state of New York. Additionally, they often serve as advocates for their clients in the event of disputes or issues with their insurance coverage.

Overall, auto insurance agents in New York State serve as invaluable resources for individuals and businesses seeking to secure appropriate and reliable auto insurance coverage.

Explaining the Different Types of Auto Insurance Policies in New York

Auto insurance policies in New York come in various types to cater to the different needs and preferences of drivers. One common type is liability insurance, which provides coverage for bodily injury and property damage that the policyholder may cause to others in an accident. This type of insurance is required by law in New York.

Another type of auto insurance is collision coverage, which helps pay for the repair or replacement of the policyholder’s vehicle if it is damaged in a collision, regardless of who is at fault. This coverage is especially important for drivers who have a newer or more valuable car.Comprehensive coverage is yet another type of auto insurance available in New York.

It provides protection for the policyholder’s vehicle against non-collision incidents such as theft, vKamulism, fire, or natural disasters. This coverage can be valuable for drivers who want to be financially protected against a wide range of potential risks.Personal injury protection (PIP) is a type of auto insurance that covers medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of who is at fault in an accident.

PIP is mKamutory in New York and can provide crucial financial support in the event of injuries resulting from an accident.Uninsured/underinsured motorist coverage is designed to protect policyholders if they are involved in an accident with a driver who either has no insurance or does not have enough insurance to cover the damages.

This coverage can be especially important in cases where the at-fault driver cannot afford to pay for the damages or does not have sufficient insurance coverage.Finally, there are additional optional coverages that policyholders in New York can consider, such as rental car reimbursement, roadside assistance, and gap insurance.

These coverages provide added peace of mind and convenience to drivers, especially in situations where they may need a rental car, encounter a roadside emergency, or owe more on their car loan than the vehicle’s actual value.It’s important for New York drivers to carefully review and understand the different types of auto insurance policies available to them.

By choosing the right coverage options, drivers can ensure they are adequately protected in the event of an accident and have peace of mind while on the road.

What to Look for in a New York State Auto Insurance Policy

When looking for a New York State auto insurance policy, it’s important to consider factors such as coverage options, deductibles, premiums, and the insurer’s reputation. Understanding the specific coverage requirements in New York, including liability, personal injury protection, and uninsured motorist coverage, is crucial.

Additionally, evaluating the insurer’s customer service, claims process, and financial stability can help ensure a reliable and responsive policy. Comparing quotes from multiple providers and reviewing policy details thoroughly can aid in making an informed decision that meets both legal requirements and individual needs.

Understanding No-Fault Auto Insurance in New York

Understanding No-Fault Auto Insurance in New York is crucial for drivers in the state. This type of insurance coverage, unique to New York, is designed to provide medical benefits and lost wage coverage to individuals involved in car accidents, regardless of who is at fault. No-fault insurance aims to expedite the claims process and ensure that accident victims receive necessary medical treatment promptly.

Under this system, drivers are required to carry a minimum amount of no-fault insurance coverage. The minimum coverage includes $50,000 for medical expenses, $2,000 for lost wages, and $25 per day for other expenses. It’s important to note that this coverage only applies to injuries sustained in motor vehicle accidents and does not cover property damage.

To file a no-fault insurance claim, accident victims must promptly notify their insurance company and submit the necessary documentation. This includes medical bills, proof of lost wages, and other related expenses. Failure to meet these requirements within the specified timeframes can result in a denial of the claim.

Overall, understanding no-fault auto insurance in New York is essential for drivers to navigate the complexities of the state’s insurance requirements and ensure they receive the necessary coverage and benefits in the event of an accident.

The Impact of Traffic Violations on Auto Insurance Rates in New York

Traffic violations can have a significant impact on auto insurance rates in New York. When drivers commit traffic offenses such as speeding, running red lights, or driving under the influence, insurance companies view them as high-risk individuals. As a result, these drivers are likely to face higher insurance premiums.

Insurance providers consider traffic violations to be indicators of a driver’s behavior and level of risk on the road. This is because drivers who engage in such violations are more likely to be involved in accidents, leading to insurance claims. Therefore, it is crucial for drivers in New York to adhere to traffic laws to maintain a clean driving record and avoid paying higher insurance rates.

By driving responsibly and avoiding traffic violations, individuals can not only ensure their safety but also keep their auto insurance rates affordable.

How Credit Scores Affect Auto Insurance Premiums in New York

Credit scores can have a significant impact on auto insurance premiums in New York. Insurance companies in the state often use credit information to determine the cost of coverage for drivers. A higher credit score can lead to lower premiums, while a lower score may result in higher costs. This practice is based on the belief that individuals with higher credit scores are less likely to file insurance claims, and therefore present lower risk to the insurance company.

However, some critics argue that this practice unfairly penalizes those with lower credit scores. It’s important for New York drivers to be aware of this factor and to take steps to improve their credit scores in order to potentially lower their auto insurance premiums.

Navigating the Auto Insurance Market for New Drivers in New York

Navigating the auto insurance market as a new driver in New York can be a daunting task. With a myriad of options and varying coverage plans, it’s crucial to conduct thorough research before making a decision. New drivers should consider factors such as their driving record, the type of vehicle they drive, and their budget when selecting an insurance policy.

Additionally, taking a defensive driving course can not only enhance driving skills but also lead to potential insurance discounts. Understanding the nuances of auto insurance in New York is essential for new drivers to make informed choices and ensure adequate coverage on the road.

Tips for Switching Auto Insurance Companies in New York State

Switching auto insurance companies in New York State can be a smart financial move if you find a better deal elsewhere. Before making the switch, it’s important to research and compare quotes from different insurers. Start by reviewing your current policy to understand your coverage and identify any potential gaps or areas where you may be overinsured.

When shopping for a new policy, consider factors such as coverage limits, deductibles, and any additional benefits or discounts offered. Be sure to also check the financial stability and customer service reputation of the new insurer. Once you’ve selected a new policy, make sure to cancel your old policy to avoid any overlap in coverage.

By following these tips, you can successfully switch auto insurance companies in New York State and potentially save money on your premiums.

The Importance of Customer Service in New York Auto Insurance Companies

Customer service plays a crucial role in the success of auto insurance companies in New York. The importance of providing excellent customer service cannot be overstated, as it directly impacts customer satisfaction and loyalty. When it comes to auto insurance, customers need to feel valued and supported throughout their journey.

From the initial inquiry to filing a claim, every interaction should be handled with care and efficiency. Prompt responses, clear communication, and personalized assistance are key factors in building trust and establishing long-lasting relationships with customers. By prioritizing customer service, New York auto insurance companies can differentiate themselves from the competition and create a positive reputation in the industry.

Ultimately, a strong focus on customer service leads to increased customer retention, positive word-of-mouth referrals, and overall business growth.

Exploring Discounts and Savings Opportunities with Auto Insurance in New York

Exploring Discounts and Savings Opportunities with Auto Insurance in New York can lead to significant cost savings for drivers in the state. By taking advantage of various discounts offered by insurance providers, New York residents can lower their auto insurance premiums. Many insurance companies offer discounts for safe driving records, completing defensive driving courses, bundling multiple policies, and installing anti-theft devices in vehicles.

Additionally, some insurers provide savings for low-mileage drivers or those with certain professional affiliations. Exploring these opportunities and comparing quotes from different providers can help New York drivers find the best coverage at the most affordable rates. Taking proactive steps to identify and leverage available discounts can result in substantial savings on auto insurance in the state.

Trends and Innovations in Auto Insurance Companies in New York State

Trends and Innovations in Auto Insurance Companies in New York State have been rapidly evolving to meet the changing needs of consumers. With the advancement of technology, companies are leveraging data analytics and telematics to personalize insurance plans based on individual driving behaviors. Moreover, there is a growing focus on green initiatives, with insurance firms incentivizing eco-friendly driving habits through discounted premiums.

In response to the digital age, many companies are streamlining their processes by offering online claim filing and virtual assistance for customer inquiries. Additionally, there is a noticeable shift towards usage-based insurance, where premiums are determined by the actual usage of the vehicle. These innovations reflect a commitment to providing more tailored and convenient services to policyholders while adapting to the dynamic landscape of the auto insurance industry in New York State.