Hello, dear readers! How are you today? Welcome to this article about navigating life insurance options. Life insurance is an important aspect of financial planning that provides protection for your loved ones in the event of your passing. With so many options available, it can be overwhelming to understand which policy is best suited for your needs. But fret not! In this article, we will guide you through the maze of life insurance choices, helping you make informed decisions that will secure your future. So, please continue reading to discover the ins and outs of navigating life insurance options.

Types of Life Insurance Policies

Life insurance policies come in various types, each tailored to meet different needs. Term life insurance provides coverage for a specific period, offering a straightforward and affordable option. Whole life insurance, on the other hand, offers lifelong coverage with a cash value component that grows over time.

Universal life insurance provides flexibility in premium payments and death benefits. Variable life insurance allows policyholders to invest in sub-accounts, offering the potential for higher returns but also greater risk.

Understanding these types of life insurance policies is crucial in making an informed decision that aligns with one’s financial goals and family’s needs.

Term Life Insurance: Pros and Cons

Life insurance is a crucial financial tool that provides protection and security for your loved ones in the event of your untimely demise. Among the various types of life insurance, term life insurance is a popular choice for many individuals.

Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. One of the key advantages of term life insurance is its affordability. Compared to other types of life insurance, term life insurance premiums are generally lower, making it more accessible for individuals on a tight budget.

Additionally, term life insurance allows policyholders to choose the coverage amount based on their specific needs, providing flexibility in tailoring the policy to fit their financial goals.Another advantage of term life insurance is its simplicity.

The policy terms and conditions are straightforward, making it easier to understand for policyholders. This simplicity extends to the application process, which is often quick and hassle-free. Term life insurance is also a suitable option for individuals who only need coverage for a specific period, such as during the years when their dependents are financially dependent on them.

However, term life insurance does have its limitations. One of the main drawbacks is that once the policy term expires, the coverage terminates, and the policyholder loses the protection provided by the insurance.

This means that if the policyholder outlives the term, they will not receive any benefits from the policy. Additionally, the premiums for term life insurance may increase when it’s time to renew the policy, especially if the policyholder’s health conditions have changed.

In conclusion, term life insurance offers affordable coverage for a specified period, providing financial security to your loved ones in case of your passing. While it has its drawbacks, such as the absence of lifelong coverage, term life insurance remains a popular choice for individuals looking for a cost-effective and straightforward life insurance option.

It’s important to carefully consider your financial needs and goals before choosing a life insurance policy.

Whole Life Insurance: Is it Right for You?

Whole life insurance is a financial product that offers lifelong coverage, making it an appealing option for many individuals. Unlike term life insurance, which expires after a set period, whole life insurance provides a guaranteed death benefit and accumulates cash value over time.

This dual advantage allows policyholders to leave a financial legacy while also using the cash value for loans or withdrawals. However, it’s essential to consider whether the higher premiums fit your budget and long-term financial goals.

For some, the stability and predictability of whole life insurance can be comforting, especially for those with dependents. Ultimately, determining if whole life insurance is right for you depends on your unique financial situation, risk tolerance, and the need for both protection and savings in your overall plan.

Universal Life Insurance: Understanding the Basics

Universal life insurance is a type of life insurance policy that offers both a death benefit and a savings component. It is designed to provide coverage for the entire lifetime of the insured, unlike term life insurance which only offers coverage for a specific period.

With universal life insurance, policyholders have the flexibility to adjust their premium payments and death benefit amounts over time. The policy accumulates cash value based on the premiums paid and the interest credited by the insurance company.

This cash value can be used to pay future premiums or as a source of funds that can be borrowed against. Universal life insurance is often seen as a flexible and versatile option for individuals who want lifelong coverage with the potential for cash accumulation.

It is important to carefully review the terms and conditions of the policy, including the cost of insurance charges and the interest rates, to ensure that it aligns with your financial goals and needs.

Universal life insurance can be a valuable financial tool for those seeking long-term protection and potential cash value growth.

Choosing the Right Life Insurance Coverage Amount

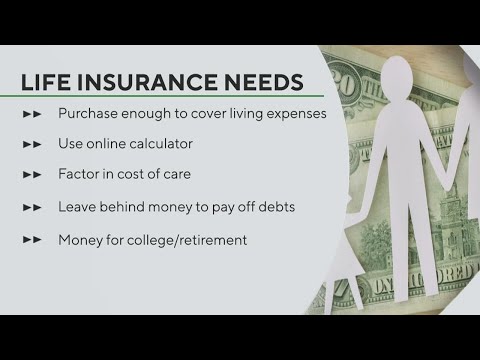

Choosing the right life insurance coverage amount is a crucial decision that requires thoughtful consideration. It’s important to assess your current financial obligations, including mortgage payments, outstanding debts, and future expenses such as college tuition for children.

Additionally, consider the financial security you want to provide for your family in the event of your passing. A general rule of thumb is to aim for a coverage amount that is 10-15 times your annual income.

However, individual circumstances vary, so it’s wise to consult with a financial advisor to determine the most suitable coverage amount for your specific needs. Taking the time to carefully assess your financial situation and future needs will ensure that you choose the right life insurance coverage amount for you and your loved ones.

Factors to Consider When Selecting a Life Insurance Provider

Tentu, saya bisa melakukannya. Ketika memilih penyedia asuransi jiwa, ada beberapa faktor yang perlu dipertimbangkan. Pertama, pastikan untuk memeriksa reputasi dan keKamulan perusahaan. Selanjutnya, perhatikan jenis produk asuransi yang ditawarkan dan apakah sesuai dengan kebutuhan Kamu.

Selain itu, bandingkan premi dan manfaat yang ditawarkan oleh berbagai penyedia untuk memastikan Kamu mendapatkan nilai terbaik. Jangan lupa untuk memeriksa persyaratan klaim dan proses klaim yang dimiliki oleh perusahaan.

Terakhir, pastikan untuk memeriksa ulasan dan pengalaman pelanggan sebelum membuat keputusan akhir. Dengan mempertimbangkan faktor-faktor ini, Kamu dapat membuat keputusan yang cerdas dalam memilih penyedia asuransi jiwa.

Key Differences Between Term and Permanent Life Insurance

Term and permanent life insurance serve distinct purposes, catering to different financial needs and preferences. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, making it an affordable option for individuals seeking temporary protection.

It pays a death benefit only if the insured passes away during the term, leaving no cash value. In contrast, permanent life insurance offers lifelong coverage and builds cash value over time, allowing policyholders to borrow against it or withdraw funds.

While term insurance is ideal for those needing coverage for specific life events, such as raising children or paying off a mortgage, permanent insurance appeals to individuals seeking long-term financial security and wealth accumulation through its investment component.

Evaluating the Financial Stability of Life Insurance Companies

Evaluating the financial stability of life insurance companies is crucial for policyholders and investors alike. This assessment involves analyzing various indicators, such as solvency ratios, investment performance, and claims-paying ability.

A strong solvency ratio signifies that a company can meet its long-term obligations, while consistent investment returns reflect prudent financial management. Additionally, examining the company’s historical claims experience provides insights into its reliability during economic fluctuations.

Regulatory frameworks further enhance this evaluation by ensuring compliance with capital requirements. As the insurance landscape evolves, understanding these metrics helps stakeholders make informed decisions, ultimately fostering trust in the life insurance sector.

By prioritizing financial stability, individuals can secure their future, knowing their insurance provider is equipped to honor its commitments.

How to Determine the Ideal Life Insurance Policy Term Length

Sure, here’s the article paragraph:When determining the ideal life insurance policy term length, it’s crucial to consider various factors. Start by evaluating your financial obligations, such as mortgage payments, debts, and future education expenses.

Take into account your age, as younger individuals may opt for longer terms to cover more years, while older individuals may need a shorter term. Health status is also vital; those with health concerns may want a longer policy to lock in insurability.

Additionally, assess your long-term financial goals and the potential need for coverage beyond the term. Lastly, review any existing policies and adjust the term length accordingly. By carefully assessing these elements, you can confidently determine the ideal life insurance policy term length for your specific situation.

Understanding the Role of Medical Examinations in Life Insurance

Medical examinations play a crucial role in the life insurance process, serving as a key factor in determining an applicant’s eligibility and premium rates. Insurers require these exams to assess an individual’s health status, including vital signs, medical history, and any pre-existing conditions.

The examination results help insurers gauge the risk associated with insuring a particular individual, ensuring that the premiums reflect the potential liabilities. Additionally, these assessments can uncover underlying health issues that may not have been disclosed during the application, promoting transparency and fairness in the underwriting process.

By understanding the importance of medical examinations, applicants can better prepare for the requirements and potentially secure more favorable insurance terms. Ultimately, these evaluations contribute to the overall integrity and sustainability of the life insurance industry.

Exploring Riders and Add-ons for Life Insurance Policies

When it comes to life insurance policies, exploring riders and add-ons can greatly enhance the coverage and protection they provide. These additional options allow policyholders to customize their plans and tailor them to their specific needs.

Riders can offer benefits such as accelerated death benefits, which provide a portion of the death benefit while the insured is still alive in the event of a terminal illness. Other riders may include options for critical illness coverage or disability income protection.

These add-ons can provide a safety net and financial support during challenging times. Moreover, some policies may offer riders for children’s coverage, allowing parents to extend the benefits to their dependents.

By exploring the various riders and add-ons available, policyholders can ensure that their life insurance plans offer comprehensive protection and peace of mind for themselves and their loved ones.

Comparing Premiums and Costs of Different Life Insurance Options

Comparing Premiums and Costs of Different Life Insurance Options can be a crucial step in making an informed decision about protecting your future and the well-being of your loved ones. When exploring life insurance options, it’s important to understand the various factors that contribute to the premiums and costs associated with each policy.

One key factor to consider is the type of life insurance you choose. Term life insurance typically offers lower premiums but provides coverage for a specific term, such as 10 or 20 years. On the other hand, permanent life insurance, like whole life or universal life, may have higher premiums but offers coverage for your entire lifetime and often includes a cash value component.

Another factor to consider is your age and health. Generally, younger and healthier individuals can secure lower premiums as they are considered lower risk. Insurance companies often require medical underwriting to determine an individual’s health status and assess the associated risks.

Additionally, your lifestyle choices and habits can impact the premiums. Insurance companies may consider factors such as smoking, alcohol consumption, and participation in risky activities when determining premiums.

Making healthy lifestyle choices can not only benefit your overall well-being but also help reduce insurance costs.Lastly, it’s essential to compare quotes from multiple insurance providers. Each company may have different underwriting guidelines and pricing structures, so obtaining quotes from various sources can help you find the best coverage at a competitive price.

In conclusion, when comparing premiums and costs of different life insurance options, it’s crucial to consider the type of insurance, your age and health, lifestyle choices, and quotes from multiple providers.

Taking the time to evaluate these factors can help you make an informed decision that suits your financial goals and provides the necessary protection for you and your loved ones.

Assessing the Importance of Policy Renewability and Convertibility

Assessing the importance of policy renewability and convertibility is crucial in today’s dynamic market. Renewability allows individuals to maintain their coverage without undergoing new underwriting processes, which can be especially beneficial as personal circumstances change over time.

This feature not only provides peace of mind but also safeguards against potential health risks that could arise during a lapse in coverage. On the other hand, convertibility offers policyholders the flexibility to transition their insurance to a different type, accommodating evolving needs as life progresses.

Together, these features empower consumers to make informed decisions, ensuring that their policies remain relevant and effective in providing financial security throughout various life stages.

The Impact of Age on Life Insurance Premiums

The Impact of Age on Life Insurance PremiumsAge plays a significant role in determining life insurance premiums. As we age, the risk of developing health issues increases, which leads to higher premiums.

Insurance companies consider age as one of the most crucial factors when calculating the cost of life insurance coverage.Younger individuals generally pay lower premiums compared to older individuals.

This is because younger people are considered to be in better health and have a longer life expectancy. Insurance companies view them as less likely to make a claim in the near future, resulting in lower premiums.

As individuals age, the likelihood of developing medical conditions such as high blood pressure, diabetes, or heart disease increases. These pre-existing conditions can significantly impact the cost of life insurance premiums.

Older individuals are more likely to have health issues, which means insurance companies may charge higher premiums to compensate for the increased risk.It’s important to note that the impact of age on life insurance premiums can vary between insurance providers.

Some companies may have different underwriting criteria that can affect the cost of coverage. Additionally, the type and amount of coverage desired can also influence the premiums.In conclusion, age plays a significant role in determining life insurance premiums.

As individuals get older, the risk of developing health issues increases, resulting in higher premiums. It’s essential to consider age when purchasing life insurance and to compare quotes from different insurance providers to find the best coverage at the most affordable price.

Navigating the Underwriting Process for Life Insurance

Navigating the underwriting process for life insurance can be a complex and overwhelming task. This crucial step determines the terms and conditions of your policy and the premiums you will pay. To successfully navigate this process, it is important to understand the key factors that underwriters consider.

Your health and medical history play a significant role, as insurers assess your risk profile based on factors such as pre-existing conditions, lifestyle choices, and family medical history. Financial underwriting, on the other hand, focuses on your income, assets, and liabilities to determine your insurability and the coverage amount you qualify for.

Providing accurate and detailed information during the application process is essential to avoid delays or potential claim denials. It is also beneficial to work with an experienced insurance agent or broker who can guide you through the underwriting process and help you find the best policy that meets your needs.

By understanding and proactively addressing the underwriting requirements, you can ensure a smoother and more successful experience in obtaining life insurance coverage.

The Importance of Reviewing and Updating Life Insurance Policies

Reviewing and updating life insurance policies is a crucial aspect of financial planning that is often overlooked. As life changes, such as getting married, having children, or buying a home, the coverage needs may evolve.

Regularly reviewing and updating life insurance policies ensures that the coverage aligns with the current financial obligations and family needs. It also provides an opportunity to take advantage of any new policy features or lower premiums that may be available in the market.

By staying proactive in managing life insurance policies, individuals can have peace of mind knowing that their loved ones are adequately protected in the event of unforeseen circumstances.

Understanding the Cash Value Component of Permanent Life Insurance

The cash value component of permanent life insurance refers to the savings account or investment feature that is included in many permanent life insurance policies. This cash value grows over time and can be accessed by the policyholder through withdrawals or loans.

It provides a level of flexibility and can be used to cover policy premiums, supplement retirement income, or meet other financial needs. Additionally, the cash value component may offer tax advantages, making it an attractive option for those seeking both insurance protection and a long-term savings vehicle.

Exploring Life Insurance as an Investment Tool

Life insurance can be more than just a safety net for your loved ones—it can also serve as a valuable investment tool. By exploring life insurance as an investment option, individuals can potentially secure financial stability for the future while enjoying the benefits of protection and growth.

With various types of life insurance policies available, such as whole life and universal life, investors have the flexibility to choose a plan that aligns with their long-term financial goals. Additionally, the tax advantages and potential for cash value accumulation make life insurance an attractive investment avenue.

When considering investment options, it’s essential to recognize the dual benefits that life insurance can offer, making it a compelling choice for those seeking to build a secure financial foundation.

Tips for Choosing Beneficiaries for Life Insurance Policies

When choosing beneficiaries for life insurance policies, it’s crucial to consider the impact of your decision. Firstly, be specific about who you want to benefit from the policy, whether it’s a spouse, children, or other loved ones.

Ensure that the beneficiaries’ information is up to date to avoid any complications in the event of a claim. Additionally, consider naming contingent beneficiaries in case the primary beneficiary is unable to receive the proceeds.

Communicate your decision with your beneficiaries to avoid any surprises and ensure they understand the policy’s purpose. Lastly, review and update your beneficiaries as life circumstances change, such as marriages, divorces, or the birth of children.

Taking these steps will help ensure that your life insurance benefits are distributed according to your wishes.

Common Mistakes to Avoid When Purchasing Life Insurance

When purchasing life insurance, it’s important to be aware of common mistakes to avoid. One common mistake is not thoroughly understanding the policy being purchased. It’s crucial to carefully review the terms and conditions to ensure it aligns with your needs and expectations.

Additionally, underestimating the coverage needed can lead to inadequate protection for your loved ones. It’s essential to accurately assess your financial responsibilities and potential future needs to determine the appropriate coverage amount.

Lastly, procrastination can be detrimental when it comes to purchasing life insurance. Delaying the decision can result in higher premiums or even the inability to obtain coverage due to health changes.

Therefore, it’s advisable to address this important matter promptly to secure the best possible terms and coverage for your circumstances.These insights are drawn from various sources, including the British Council Indonesia Foundation and the Blog English Academy.